Metropolitan Stock Exchange Unlisted Shares

METROPOLITAN STOCK EXCHANGE

METROPOLITAN STOCK EXCHANGE

Metropolitan Stock Exchange of India Limited (MSE) is appreciate by Securities and Exchange Board of India (SEBI) under Section 4 of Securities Contracts (Regulation) Act, 1956. The Exchange was notice as a “recognized stock exchange” under Section 2(39) of the Companies Act, 1956 by Ministry of Corporate Affairs, Govt. of India, on December 21, 2012.

For your kind information Shareholders of the Exchange include India’s top public sector banks, private sector banks and domestic financial institutions who, together hold over 88% stake in the Exchange. MSE is apply to CAG Audit and has an independent professional management.

Best practices and regulatory essential, clearing and settlement of trades done on the Exchange are conducted through a separate clearing corporation − Metropolitan Clearing Corporation of India Ltd.

Metropolitan Stock Exchange (MSEI) Unlisted Shares:

- Metropolitan stock exchange shares buy sell

- Buy Metropolitan stock exchange shares

- Sell Metropolitan stock exchange shares

- Shares of Metropolitan stock exchange

- Buy MSE shares

- Sell Shares of MSE

- Shares of MSE

Metropolitan Stock Exchange of India Limited (MSEI) is a full-service national level Stock Exchange with a license to operate in Equity, Equity Derivatives, Currency Derivatives, Debt and SME Platform.

It has a live trading platform in all segments except SME. MSEIL has two subsidiaries: Metropolitan Clearing Corporation of India Limited (MCCIL) and MCX SX KYC Registration Agency Limited (MRAL) in which it holds 86.94 and 100 percent. MCCIL is in the business of clearing and settlement of deals in multi-asset classes carried out at MSEIL and MRAL is in the business of maintaining a database for members of the exchange and other under the Know Your Client (KYC) Guidelines.

Key Highlights

(i) The ownership of MSEIL is diversified between corporates, banks and individuals.

(ii) The shareholding of MSEIL consists of Banks/Flls at 23.64% which includes leading public and private sector banks like State Bank of India, Bank of Baroda, Punjab National Bank, Axis Bank, HDFC Bank, etc.

(iii) Leading Corporates and institutions hold around 29.94% which includes Edelweiss Commodities Services Limited, IL&FS Financial Services Limited, Multi Commodity Exchange of India Limited, etc.

(iv) Individual Investors hold around 40.47% which includes leading investors like Mr. Rakesh Jhunjhunwala, Mr. Radhakishan Damani, Mr. Nemish Shah among others.

Metropolitan Stock Exchange (MSEI) Unlisted Shares Details:

| Total Available Shares: | 1000000 |

| Face Value: | ₹ 1 Per Equity Share |

| ISIN: | INE312K01010 |

| Lot Size: | 10000 Shares |

| Current Unlisted Share Price: | ₹ Best in industry Per Equity Share |

| Retail Discount: | Bulk Deal (5%) |

Promoters And Management:

Promoters and Director of Metropolitan Stock Exchange (MSEI) Unlisted Shares Company are:

| NAME | DESIGNATION |

| Mr. Udai Kumar |

Managing Director & CEO |

| Prof. Ashima Goya | Chairperson & Public Interest Director |

| Mr. D. G. Patwardhan | Public Interest Director |

| Mr. D. K. Mehrotra | Public Interest Director |

| Mr. Ajai Kumar | Public Interest Director |

| Mr. Ketan Vikamsey | Public Interest Director |

Shareholding Pattern:

Top 10 Shareholders of MSEI as on 31.03.2019

| Sr.no | Name of the Shareholder | No.of Shares | %age |

| 1 | Multi Commodity Exchange of India | 33,17,77,008 | 6.90% |

| 2 | Siddharth Balachandran | 23,84,09,950 | 4.96% |

| 3 | RADHAKISHAN S Damani | 11,93,63,496 | 2.48% |

| 4 | TRUST INVESTMENT Advisors private Limited | 11,91,15,930 | 2.48% |

| 5 | IL AND FS FINANCIAL SERVICES LIMITED |

119,109,627 | 2.48% |

| 6 | UNION BANK OF India | 10,87,50,000 | 2.26% |

| 7 | STATE BANK OF India | 9,74,00,000 | 2.02% |

| 8 | NEMISH S SHAH | 9,73,70,000 | 2.02% |

| 9 | AADI FINANCIAL Advisors LLP | 9,73,50,000 | 2.02% |

| 10 | KUMAR CHIMANLAL MEHTA | 8,87,54,112 | 1.85% |

Financials of Metropolitan Stock Exchange (MSEI) Unlisted Shares:

| Consolidated Financial Performance | ||||

| Particulars (Rs. In Lakhs) | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| Total Revenue | 3200.64 | 3638.37 | 2828.06 | 3520 |

| Profit/Loss Before Tax (PBT) | -4005.34 | -3258.25 | -5476.3 | -3845 |

| Profit/Loss After Tax (PAT) | -4005.34 | -3258.25 | -5474.85 | -4059 |

| Earnings per share (EPS) | -0.16 | -0.15 | -0.15 | -0.08 |

Other Highlights |

|

|

Particulars (Rs.In Cr) |

Year-2019 |

|

Equity Capital |

480.52 |

|

Net Worth |

371.07 |

|

Book Value Per Share |

0.77 |

|

Face Value (In Rs.) |

1 |

Review of Consolidated Financials Of MSEI For FY18-19

(i) The MSEI has seen a Revenue jump of 25% in FY18-19 as compared to last year. The jump mainly due to ” other income”. The Trading income remains flat at 8.04 Cr.

(ii) The MSEI has incurred losses of Rs.40 Crore in FY18-19, the losses reduced by ~14 Crore, as compared to the previous year’s loss of Rs.54 Crore. The losses have been curtailed due to a reduction in “Advertisement & business promotion expenses “.

(iii) The EPS for FY18-19 stands at -0.08 an increase of 100%. Last year it was -0.15.

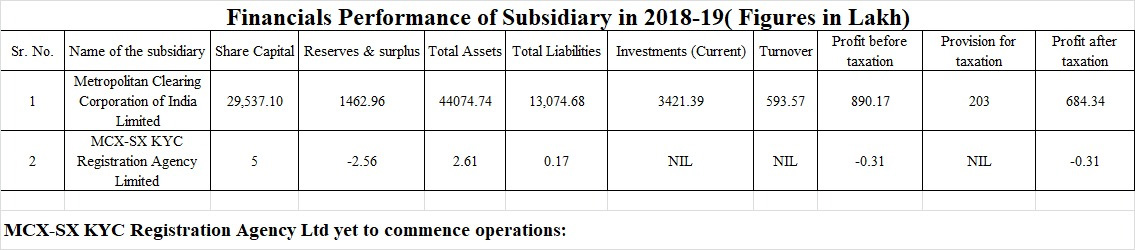

(iv) Financials of MSEI Subsidiary in 2018-19.

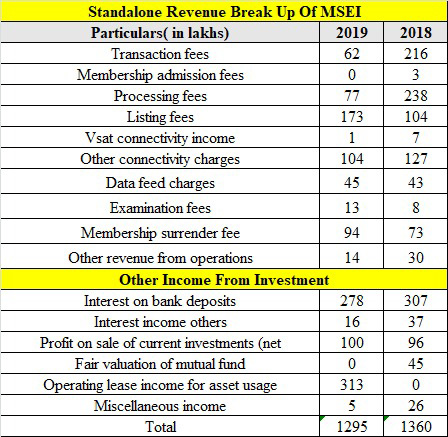

(v) Revenue break-up of MSEI on a Standalone basis. This bifurcation is being done to know, how the company is earning revenue from different products.

Company Address:

Metropolitan Stock Exchange of India Limited,

Vibgyor Towers, 4th floor, Plot No C 62, G – Block, Opp.

Trident Hotel, Bandra Kurla Complex, Bandra (E),

Mumbai – 400 098, India.

phone No. +91 22 6112 9000

Website: www.msei.in

Buy shares of Chennai Super Kings Buy Shares of ONE97 COMMUNICATIONS Buy shares of Hdb financial services Buy shares of Bharat Nidhi ltd Buy shares of Paytm Buy Shares of Indofil industries ltd